Construction Insurance and Surety Solutions

Make Informed Decisions Faster

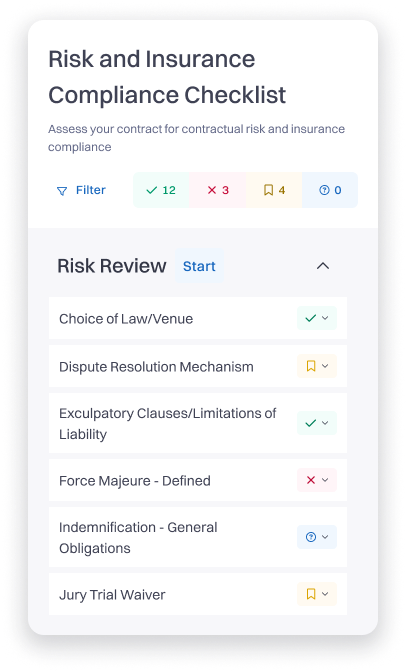

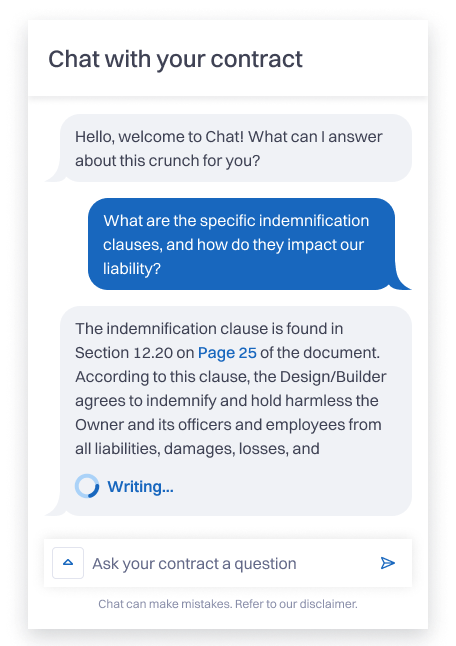

The insurance industry plays a critical role in construction risk management, ensuring that contractors have the right coverage and financial protection in place. But navigating complex contracts, policy terms, and surety obligations can be time-consuming and inefficient.

We simplify the process by providing automated contract insights that help brokers, underwriters, and sureties make informed decisions faster.

Smarter Risk Management for Insurance Professionals

For Underwriters

- Automating contract reviews to flag high-risk clauses

- Identifying exposures that could lead to higher claims

- Improving underwriting accuracy and efficiency for better decision-making

For Sureties

Surety bonds are a cornerstone of risk management, ensuring that construction projects are completed as promised. But issuing bonds without fully understanding contract risk can expose sureties to financial losses. Our technology helps sureties:

- Assess bond obligations against contract terms to spot potential risks before issuing coverage

- Identify contractual red flags that could lead to bond claims or disputes

- Enhance risk profiling to make faster, more accurate decisions

By integrating smart contract insights into the bonding process, sureties can minimize their exposure and approve bonds with greater confidence.

Envisioning a Future with Zero Disputes

& Stronger Relationships

for those who build the world.